Views: 0 Author: Site Editor Publish Time: 2024-08-15 Origin: Site

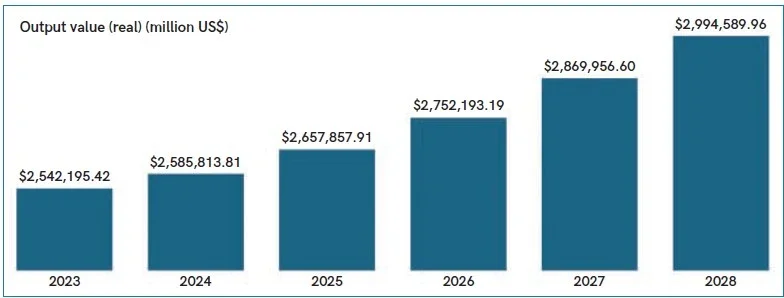

The North America construction market is big; market size is evaluated at $2,585.8 billion in 2024. And the good news is it’s expected to grow at a rate of 3.7% during 2024-2028, says information services company GlobalData.

Staff Writer July 10, 2024

The North American construction market size revenue is projected to reach $2,585.8 billion in 2024 and is expected to grow at a compound annual growth rate of more than 3% over the forecast period (to 2028).

Continued urbanisation, population growth, and the need for modern infrastructure propel demand across residential, commercial, and industrial sectors. Government initiatives for infrastructure development, including transportation, energy, and public facilities, further bolster market growth.

Moreover, increasing focus on sustainability and green building practices shapes the market, with a growing demand for energyefficient and environmentally friendly construction projects.

MANUFACTURING THE FUTURE

The regional construction market is observing a steady build-up in both public and private investments. For instance, as per statistics released by the US White House, nearly $688 billion worth of investments are pledged by private companies as part of an initiative called ‘Manufacturing the Future’.

This commitment to investing in different industrial verticals includes semiconductors and electronics ($245 billion), EVs and batteries ($165 billion), clean energy manufacturing ($77 billion), biomanufacturing ($27 billion), heavy industry ($33 billion), and clean power ($141 billion).

The regional dynamics improved primarily supported by the growth of the US construction sector which accounted for a majority share in real terms in 2023. For example, according to data from the US Census Bureau, the total construction put in place experienced a nearly 7% yearover- year growth in nominal value in 2023, with the non-residential sector emerging as a key driver, showing an annual growth rate of over 19%. This growth in the nonresidential sector, supported by the robust performance of the US construction industry, contributed significantly to regional dynamics, representing a majority share in real terms in 2023.

NEGATIVE GROWTH

On the other hand, the Canadian construction industry showcased a negative growth trajectory in 2023 owing to the declining number of new building permits.

As per the data released by Statistics Canada, the total value of building permits declined by over 7% on a YoY basis in 2023. This downfall was primarily attributed to the 14% YoY fall in new residential building permits.

Over the forecast period, however, the regional growth momentum is likely to pick up with an annual average growth rate (AAGR) of over 3.5% from 2025 to 2028. This growth is predicted to be supported by the increasing focus of the US and Canadian governments on the development of industrial, energy, and infrastructure sectors.

For example, in October 2023, the US government announced the allocation of $61 billion in funds to support investments in critical infrastructure including roads, tunnels, and bridges. Similarly, in November 2023, the government of Canada launched the Critical Minerals Infrastructure Fund (CMIF) of $1.2 billion, to support projects of clean energy, electrification, and transportation over the next seven years.

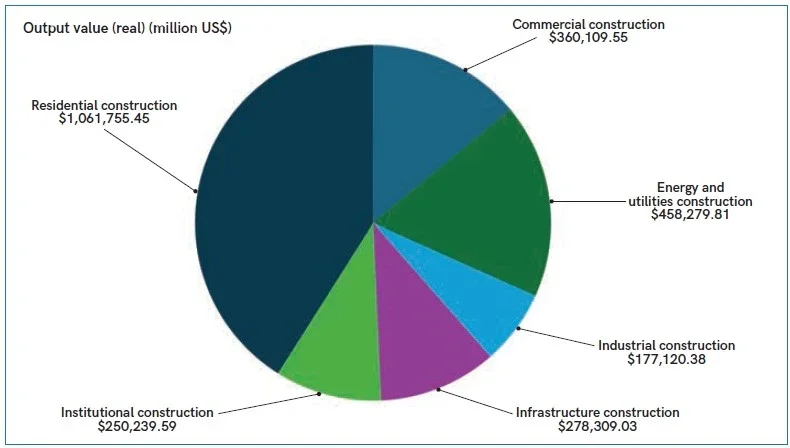

SECTOR INSIGHTS

The residential construction sector is predicted to dominate the regional market in terms of output value (Real) in 2024. This sector at a regional level recorded a declining trend in 2022 and 2023, owing to the weak macroeconomic conditions. The high inflationary pressure and elevated mortgage rates directly impacted the new residential building permits during this timeline.

For example, new housing construction in the US declined by 9% in 2023 as compared to the previous year. A similar trend was observed in Canada as well over the mentioned timeframe.

The energy and utilities construction sector is set to emerge as the second-largest segment in 2024 in terms of output value (Real).

The segment registered strong growth in 2023 and is expected to continue on a similar trajectory over the forecast period, aided by the rising spending on clean energy projects. For instance, in April 2024, the US Department of Interior announced that it has permitted over 25 gigawatts of clean energy sites including solar, wind, and geothermal projects.

Similarly, in November 2023, to cut down carbon emissions in Canada, over $161 million was allocated for the construction of a new 230kV transmission line in the Southwest Manitoba region. The project is set to cut down carbon dioxide emissions by around 37%.

The regional commercial construction sector is set to record stable growth with an anticipated annual average growth rate of over 1% from 2025 to 2028.

The segmental growth over the forecast period is set to be supported by the rising investments in data centres. For example, in February 2024, Meta announced its plans to invest approximately $800 million to establish a 700,000-squarefoot facility in Jeffersonville, Indiana. The building of this data centre is set to generate over 1,000 construction jobs during peak construction activity and an additional 100 operational jobs.

The regional infrastructure construction segment is set to record a double-digit YoY growth in 2024 and is projected to follow a similar growth trend over the predicted timeline. This segmental growth is to be aided by continuous investment from the regional governments to expand the transportation network.

For example, in the US, as part of the Rebuilding Infrastructure Program, the government announced an investment of $285 billion for the development of roads, ports, airports, and bridges.

Similarly, in Canada, the Ontario state government in March 2022 announced a ten-year plan to develop a local transportation network. This ten-year investment plan includes an allocation of over $65 billion for the construction of rail corridors, highways, and subways.

The regional institutional construction sector is poised to register a compound annual growth rate of 3.0% over the forecast period. The segmental growth over the predicted timeline will be supported by investments in education and healthcare domains.

For example, in February 2024, the state government of Saskatchewan in Canada awarded a contract worth $898 million to PCL Construction Management Inc. The contract work includes the building of a new acute care tower at Prince Albert Victoria Hospital with features such as a helipad on the roof, operating rooms, and an emergency department.

The industrial segment is predicted to emerge as the smallest category in 2024. The segmental growth over the projected timeframe is to be aided by the mining expansion activities. For instance, in August 2023, ArcelorMittal awarded pit development work for its Mont-Wright mine in the Quebec region to Bird Construction for an undisclosed sum. The contract work includes stripping, drilling, and blasting of 24 million tons of waste and iron ore.

ANALYSIS BY COUNTRY

The North American construction industry registered a growth in output value in real terms in 2023. The market scenario is set to remain in a similar mode in 2024, however, the YoY growth is estimated to decline by approximately 0.6% as compared to the previous year. This decline is partially influenced by the slowdown in the construction sector of Canada in 2024.

The construction sector in Canada is poised to record a negative trajectory in 2024 owing to the expected decline in the domestic housing market.

As per the National Housing Agency, the weak housing conditions are influenced by the surge in borrowing costs making new projects less attractive to developers. Moreover, as per the forecast given by the Canadian Mortgage and Housing Corporation (CMHC), new home construction is estimated to decline from 240,267 units in 2023 to 224,485 units in 2024, a decline of over 6% on a YoY basis.

The US construction sector is estimated to emerge as the dominant regional market in 2024 and is expected to continue its dominance over the projected timeline. The construction market in the US is predicted to be swayed by infrastructure spending. The domestic infrastructure sector is set to register an annual average growth rate (AAGR) of over 11% from 2025 to 2028, supported by the government’s effort to amplify the transportation infrastructure across the country. For example, in January 2024, the federal government announced funding of nearly $5 billion in 37 projects through two grant programmes including National Infrastructure Project Assistance and Infrastructure for Rebuilding America.

Another key sector that is poised to showcase its influence on the US construction market over the forecast period is the energy and utilities category. This segment is projected to record a compound annual growth rate of over 8% over the predicted timeline. The segmental growth is to be primarily driven by the increasing investments in renewable energy projects. For instance, in January 2024, the United States Department of Agriculture (USDA) announced an investment of $157 million across 42 states through the Rural Energy America Program (REAP).